Section 179 and What It Can Do for You

Section 179 of the tax code allows businesses to deduct “the full purchase price of qualifying  equipment or software purchased or financed during the tax year.” This essentially means that if you buy a piece of equipment that qualifies, you are able to deduct the full purchase price from your taxable income.

equipment or software purchased or financed during the tax year.” This essentially means that if you buy a piece of equipment that qualifies, you are able to deduct the full purchase price from your taxable income.

In 2018, the deduction limit was raised to $1,000,000 with a cap on total equipment purchase of $2.5 million. This is a significant increase over the $500,000 deduction limit in 2017.

But, as the year winds down, the clock is ticking on taking advantage of the tax deductions. Remember, you must:

- buy or lease equipment, AND

- put it into service before the end of the year

Tax Break for Businesses Large and Small

Your business can claim the full deduction if you purchase $5,000 to $2,500,000 worth of equipment, including:

- Vehicles with 6,000+ lbs. gross vehicle weight designed for commercial use

- Off-the-shelf computer software with a non-exclusive license

- Business equipment of all types that’s not permanently installed (machinery, storage tanks, other commercial equipment)

- Computers, office furniture and office equipment

- Storage facilities/property attached to your building but not a structural component of it (manufacturing tools and equipment)

These tax incentives could allow you to write off capital investments and keep thousands of dollars that impact on your bottom line. During tight market periods, this reason alone can make a huge difference when it comes to making big purchase decisions. In fact, did you know that you can lease equipment and still take full advantage of the deduction? That’s true.

But wait, there’s more! Equipment does not have to be new: it can be used but new to you. Think of it  this way, almost any portable piece of business equipment will likely qualify. Even batteries? Generally, large serialized batteries are considered capital purchases.

this way, almost any portable piece of business equipment will likely qualify. Even batteries? Generally, large serialized batteries are considered capital purchases.

However, capital spending can be defined differently for various industries and companies, so please consult with your tax advisor. If you are not sure whether your equipment qualifies, talk to a professional to determine if you are in compliance. While Section 179 deductions can offer a tremendous advantage to companies across the U.S., you’ll want to ensure that legal requirements are being met for all deductions. Better to find out now than on April 15.

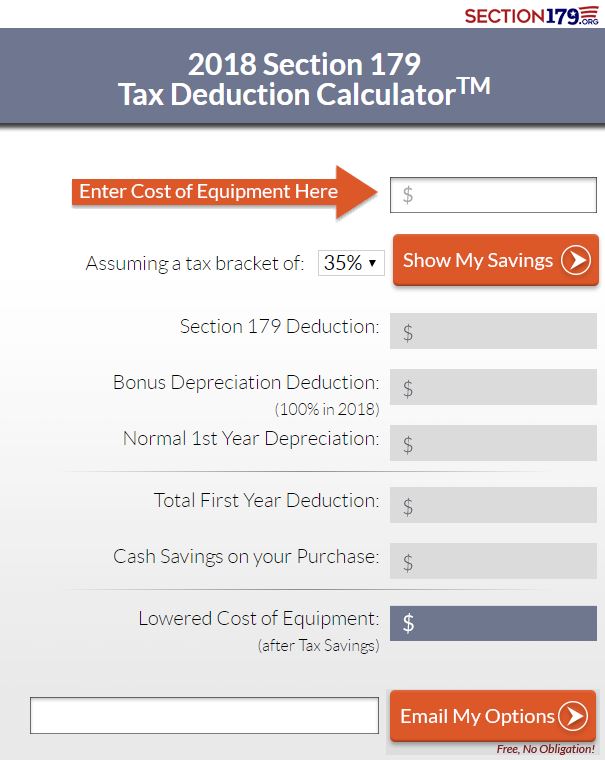

Stay competitive by purchasing the equipment, vehicles, and software you need now and save with the Section 179 Tax Deduction. Run some numbers with this handy 2018 Tax Deduction Calculator to see how much you can save this year.

Bottom Line

If you’re interested in buying material handling equipment, there’s still time. Whether you purchase or finance equipment, Section 179 offers a great way to positively impact your bottom line for the foreseeable future. Explore your options today with a material handling expert at Abel Womack. We can help you determine your equipment needs and find smart ways to spend on capital expenditures before this deduction runs out.

Leave a Reply

You must be logged in to post a comment.