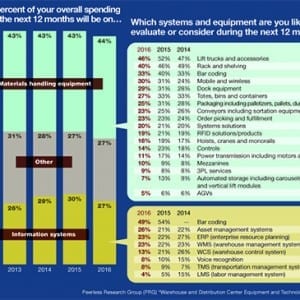

Capital expenditure plans for materials handling solutions are ebbing overall, but restrained spending on hardware is balanced by steady investment in IT solutions that tie equipment together. 2015 Warehouse/DC Equipment Survey: Smarter funding for the future Reader Survey: Conveyor technology’s silver lining Lift truck user survey: How customers acquire, maintain and replenish their fleets 2014 Lift Truck User Survey: Readers feel optimistic, ready to spend Lift truck user survey: Readers report steady growth Reader Survey: Lift trucks are back Investment in materials handling solutions in warehousing, manufacturing and distribution facilities has tapered for the first time in recent years, and sentiments suggest changing priorities in the near term. The results of Peerless Research Group’s (PRG) “2015 State of Warehouse/DC Equipment Survey” suggest a significant softening of investments for the first time since the recession. More than 20% of respondents say they are holding off on investments, up from an average of 14% in the previous four years. After 35% said they plan to move ahead with investments in 2015, just 28% still have irons in the fire. However, 20%—also the highest since the downturn—say the economy is having little or no effect on their spending decisions. According to John Hill, managing director at St. Onge Co., a consulting firm specializing in designing and implementing solutions for manufacturing, warehouse and distribution operations, the survey results are well-aligned with recent Material Handling Equipment Manufacturing (MHEM) forecasts published by MHI. “After record increases in 2015, new orders and shipments of 6.1% and 7.2% respectively, the outlooks for this year and next suggest caution,” Hill says. “Indeed, the MHEM projects that reduced domestic demand will lead to a 13% fall off in new orders in 2016 followed by a 7.8% drop in 2017 with revenues for those two years falling by 6.9% and […]